Recession discussions are making headlines, and with the chances of one occurring increasing this year, many are left wondering how it could impact the housing market.

Let’s take a closer look at historical trends to understand how housing has reacted during previous recessions since the 1980s.

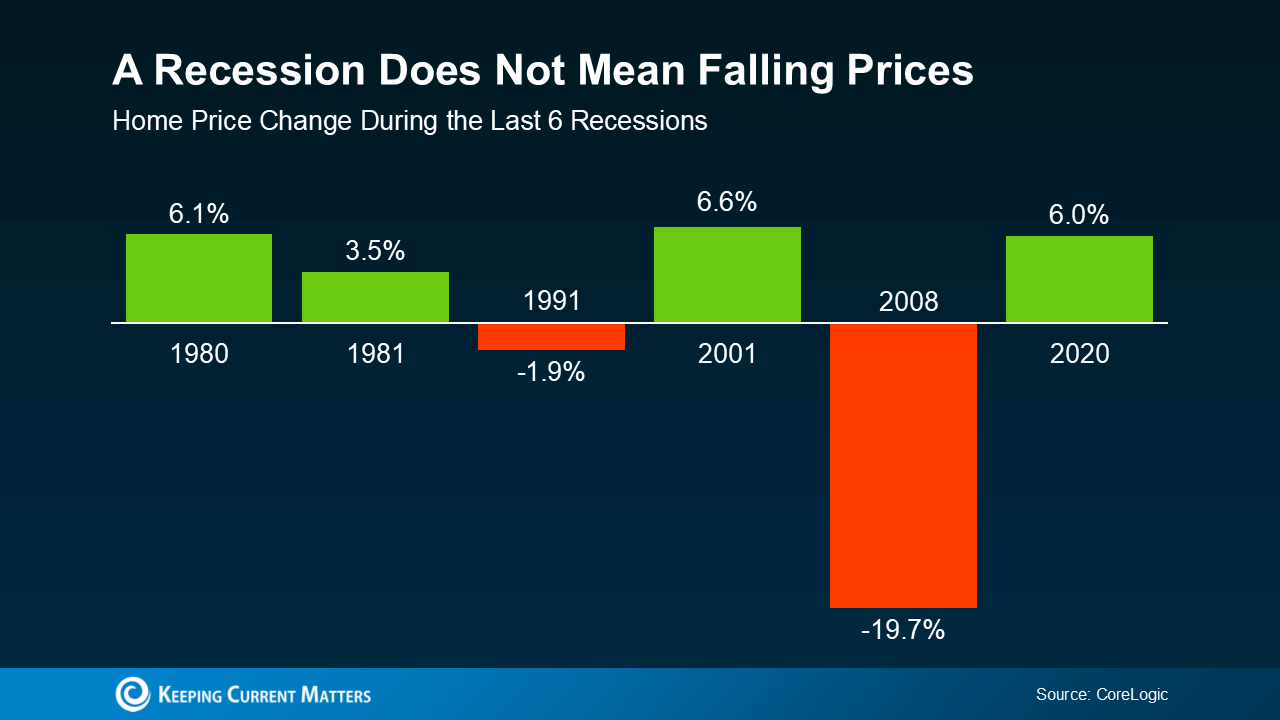

Recessions Don’t Always Lead to Falling Home Prices

A common belief is that home prices will drop if the economy enters a recession, similar to what happened in 2008. However, that was a unique case, and not a typical outcome. The sharp decline in home prices during the 2008 recession was an anomaly, and it hasn’t been repeated since.

In fact, data from CoreLogic shows that in four of the last six recessions, home prices actually increased.

So, if you're planning to buy or sell, don’t assume that a recession will automatically cause a market crash. The data suggests that home prices usually continue on their existing trajectory. At present, home prices are rising at a more typical rate across the country.

Mortgage Rates Tend to Drop During Recessions

While home prices generally stay on their current path, mortgage rates often fall during economic slowdowns. Historical data from the last six recessions supports this pattern (as shown in the graph below).

This means that a recession could lead to lower mortgage rates, which could help with affordability. However, don't expect rates to return to the record lows seen in the past, such as the 3% levels.

In Conclusion

While the possibility of a recession is growing, its exact impact on the housing market remains uncertain. However, historical trends provide a clear picture of what we can typically expect. Based on past data, recessions don’t always lead to crashing home prices, and mortgage rates usually decline.